louisiana inheritance tax return form

Underpayment of Individual Income Tax Penalty Computation- Non-Resident and Part-Year Resident. An inheritance tax is a tax imposed on someone who inherits money from a deceased person.

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Its also a community property estate meaning it considers all the assets of a married couple jointly owned.

. Estate Transfer Taxes Who must file an estate transfer tax return. A background of inheritance taxes. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount.

Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Addresses for Mailing Returns. If estate is worth 15 million 3.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. Requirements for Filing Returns Inheritance taxAn inheritance tax return must be prepared and filed for each succession by or on behalf of all the heirs or legatees in every case where inher- itance tax is due or the value of the deceaseds estate is 15000 or more LSA-RS. If the estate is the beneficiary income in respect of a decedent is reported on the estates Form 1041.

Louisiana does not impose any state inheritance or estate taxes. Louisiana inheritance tax return form. 49 million before doubling to 11.

The economic growth and tax relief reconciliation act of 2001 phased out the. The 5 million exemption will return for deaths occurring in 2026 and thereafter unless congress votes to extend the larger exemption. For office use only.

Does louisiana have an inheritance tax or estate tax. 2 million in 2018. Payment of the tax due must accompany the return.

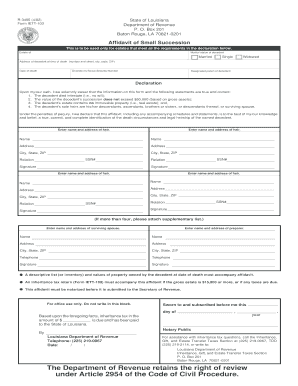

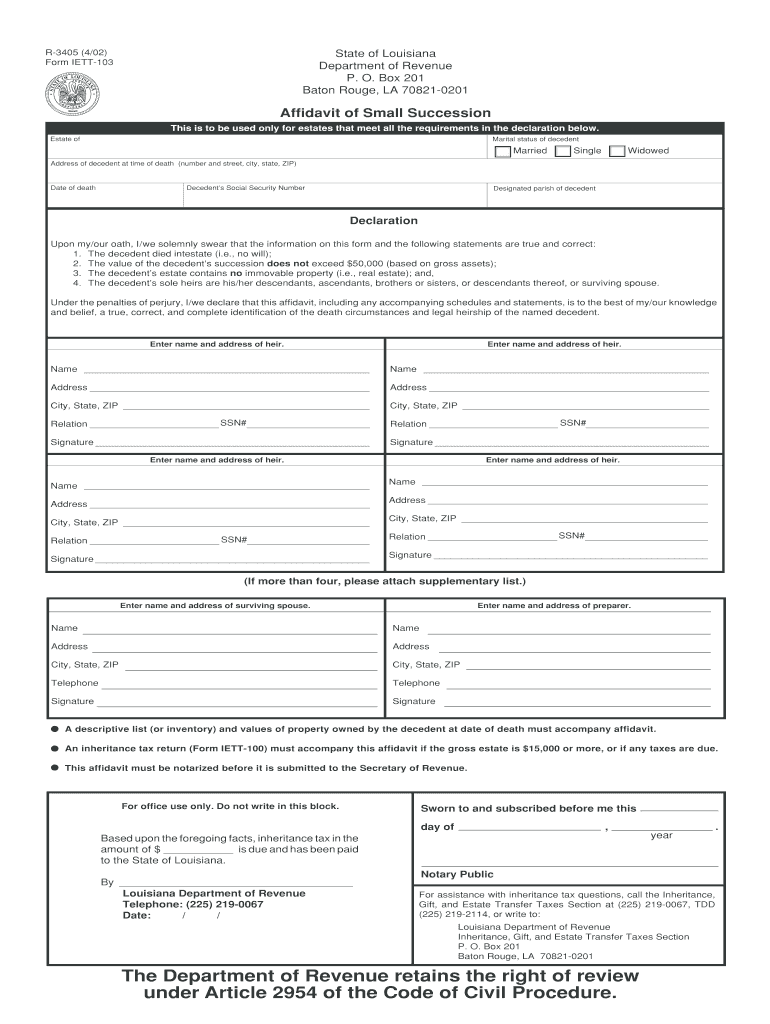

This affidavit must be notarized before it is submitted to the Secretary of Revenue. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. 11012009 - present.

This right is called a usufruct and the person who inherits this right is called a usufructuary. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due. This affidavit must be notarized before it is submitted to the Secretary of Revenue.

Form 1029 sales tax return. This affidavit must be notarized before it is submitted to the Secretary of Revenue. An inheritance tax is a tax imposed on someone who inherits money from a deceased person.

If the estate reported the income in respect of a decedent on its income tax return you dont need to report it as income on your income tax return. What to Bring When Visiting LDR. Louisiana does not impose.

Underpayment of Individual Income Penalty Computation Resident Filers and Instructions. In fact as discussed below the Louisiana Department of Revenue has stopped issuing receipts It is unclear whether people who died on or before June 30 2004 will be subject to inheritance tax if an inheritance tax return was filed before July 1. If less than zero enter zero Schedule V Summary of Inheritance Tax Estate Transfer Tax and Interest Due 1 Inheritance tax due From Line 7 Schedule IV 2 Estate transfer tax From Line 8 Schedule IV 3 Interest due on inheritance and estate transfer taxes See instructions.

6 million is tax at 40 percent. Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or. Can I deposit an inheritance check.

An inheritance tax return shall be prepared and filed by or on behalf of the heirs and legatees in every case where inheritance tax is due or where the gross value of the deceaseds estate amounts to the sum of fifteen thousand dollars or more. While the tax rate has remained the same over the years back in 2017 exclusion amount was 5. No inheritance tax is owed and theres no need to file an Inheritance and Estate Tax Return with the Louisiana Department of Revenue.

RS 2425 - Inheritance tax return. 1 Total state death tax credit allowable Per US. If you take a check.

Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. 8 Louisiana estate transfer tax Subtract Line 7 from Line 3. Repealed by Acts 2008 No.

Often in Louisiana one person will inherit the right to use property and receive the fruits income from property. Find out when all state tax returns are due. For office use only.

If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. Estate transfer taxAn estate transfer tax return must be prepared and filed for each. An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due.

Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. Do not write in this block. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

An inheritance tax return Form IETT-100 must accompany this affidavit if the gross estate is 15000 or more or if any taxes are due. In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary.

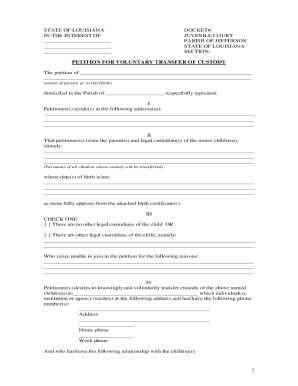

Voluntary Transfer Of Custody Louisiana Fill Out And Sign Printable Pdf Template Signnow

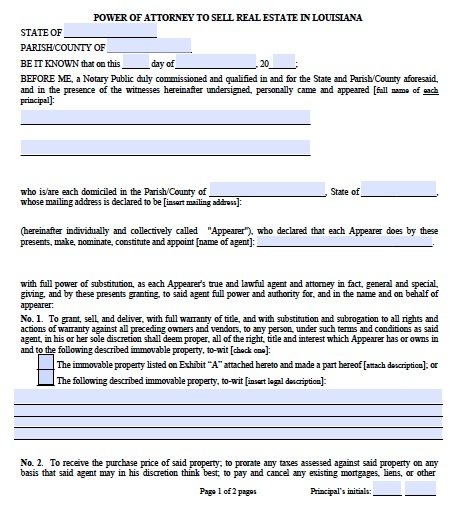

Free Real Estate Power Of Attorney Louisiana Form Pdf

Small Estate Affidavit Louisiana Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Revenue Louisiana Form R 1058 Louisiana State Tax Fax Email Print Pdffiller

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

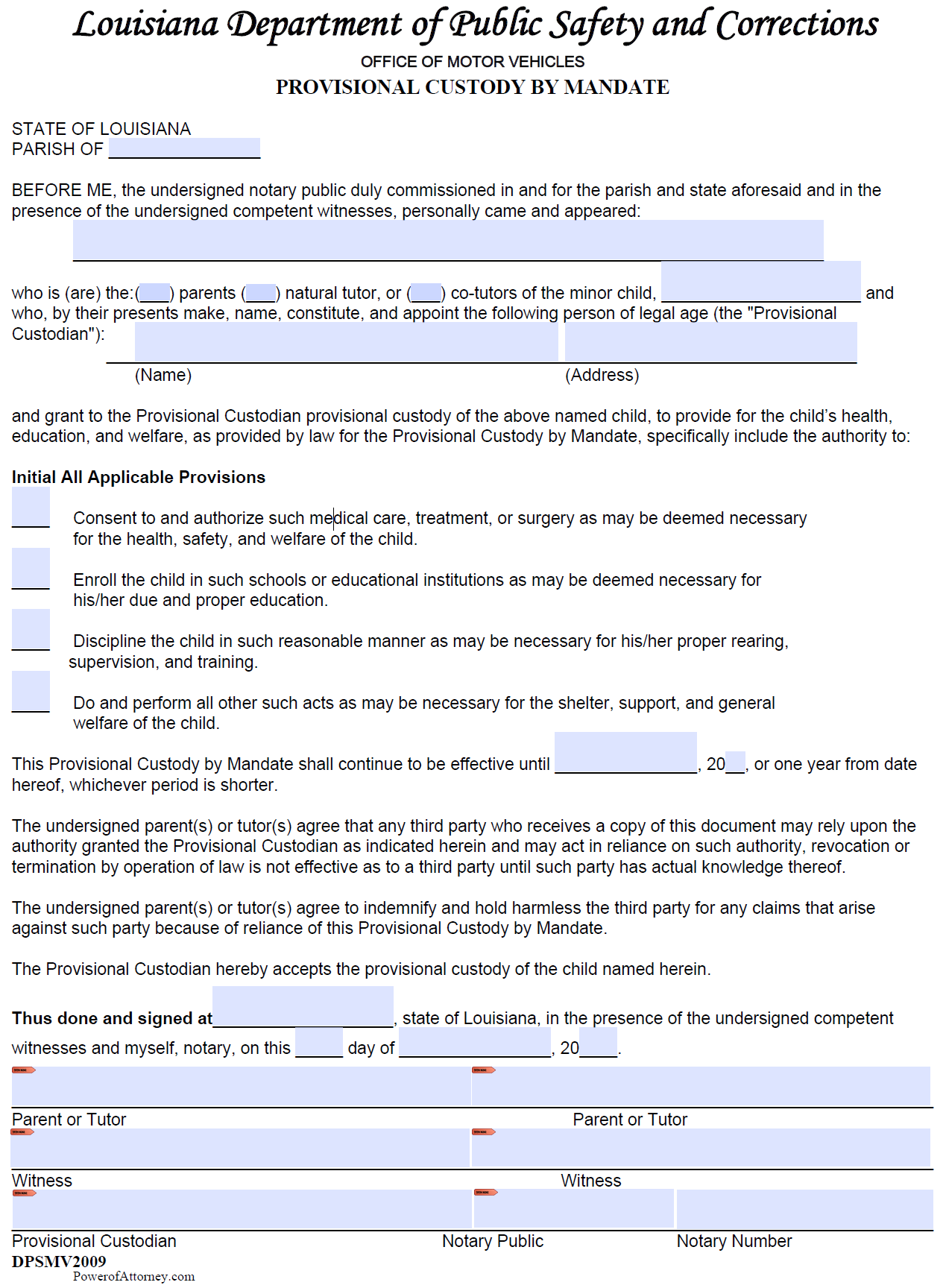

Free Minor Child Power Of Attorney Louisiana Form Pdf

Free Louisiana Last Will And Testament Template Pdf Word Eforms Free Fillable Forms Last Will And Testament Will And Testament Louisiana

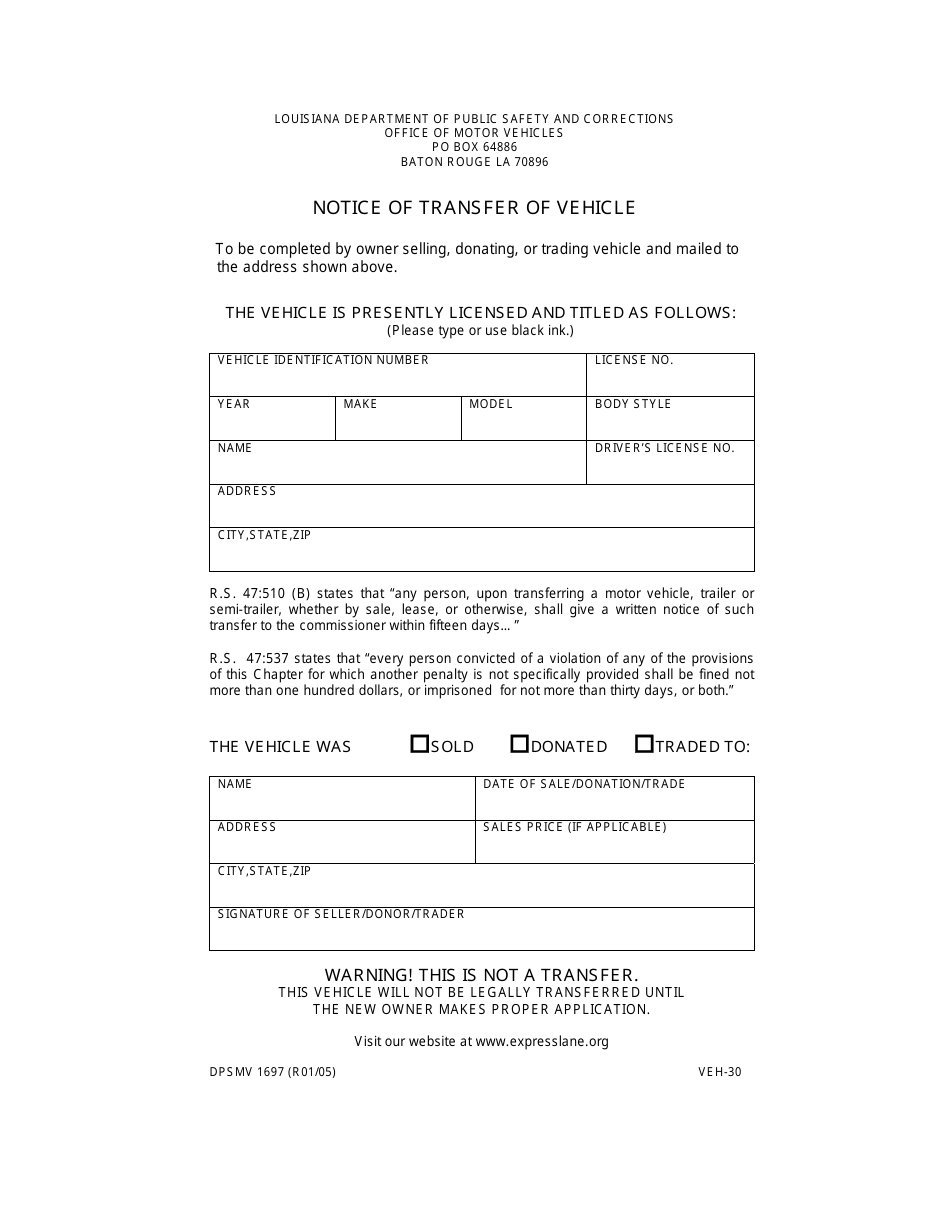

Form Dpsmv1697 Veh 30 Download Printable Pdf Or Fill Online Notice Of Transfer Of Vehicle Louisiana Templateroller

Free Louisiana Revocable Living Trust Form Word Pdf Eforms

Free Louisiana Security Deposit Demand Letter Pdf Word Eforms Free Fillable Forms Being A Landlord Lettering Notes Template

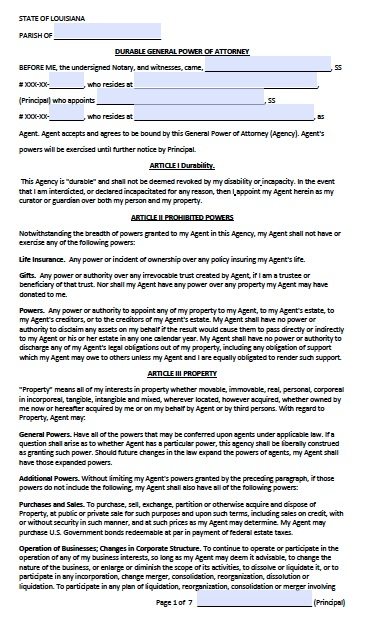

Free Durable Power Of Attorney Louisiana Form Adobe Pdf Template

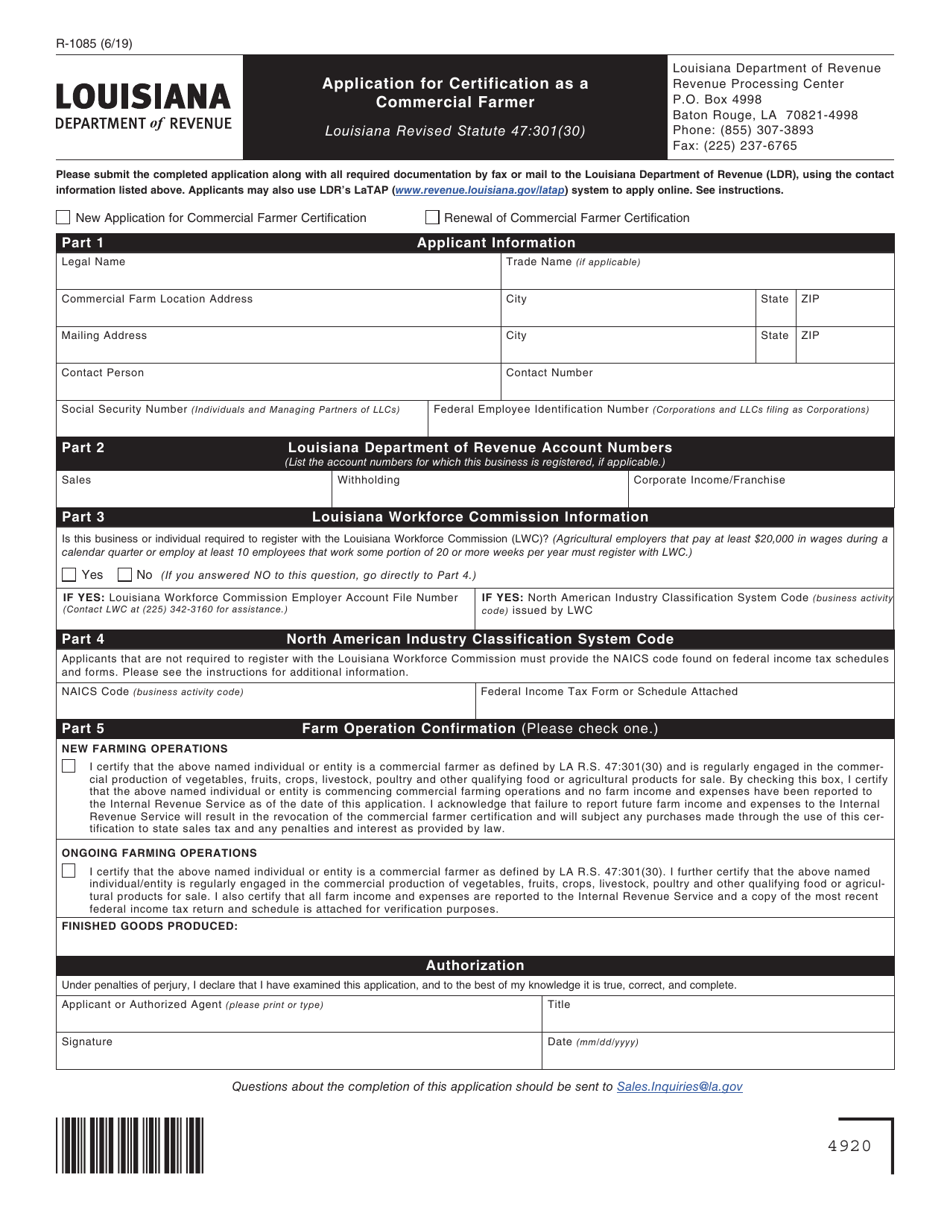

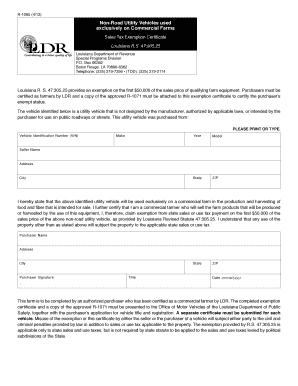

Form R 1085 Download Fillable Pdf Or Fill Online Application For Certification As A Commercial Farmer Louisiana Templateroller

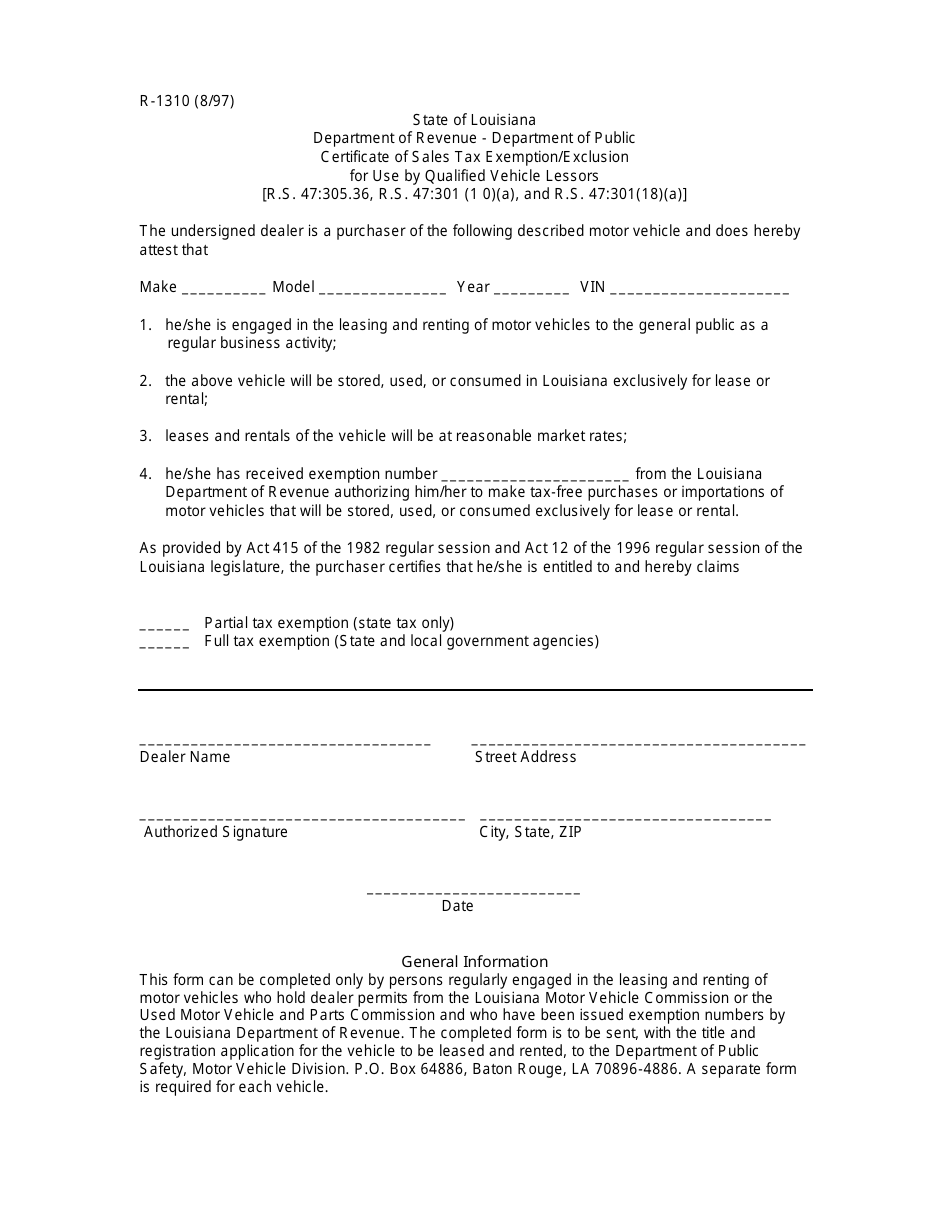

Form R 1310 Download Fillable Pdf Or Fill Online Certificate Of Sales Tax Exemption Exclusion For Use By Qualified Vehicle Lessors Templateroller

2011 Form La R 1300 Fill Online Printable Fillable Blank Pdffiller

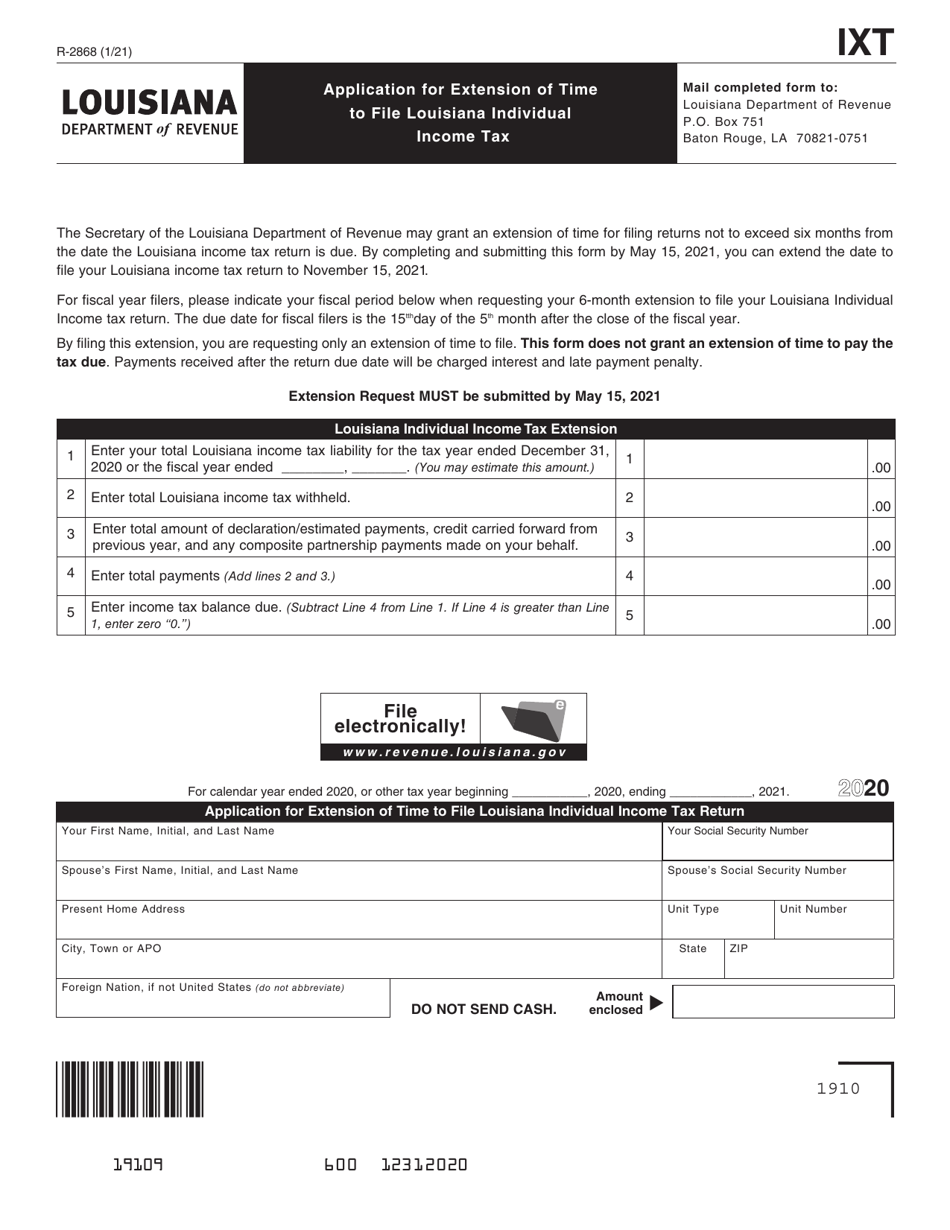

Form R 2868 Download Fillable Pdf Or Fill Online Application For Extension Of Time To File Louisiana Individual Income Tax 2020 Templateroller

Louisiana Small Succession Affidavit Pdf Fill Online Printable Fillable Blank Pdffiller

Form 1311 Fill Online Printable Fillable Blank Pdffiller

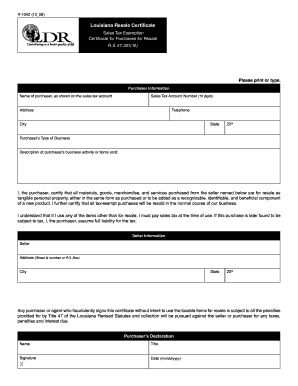

Louisiana Resale Certificate R 1064 Pdf Fill Out And Sign Printable Pdf Template Signnow

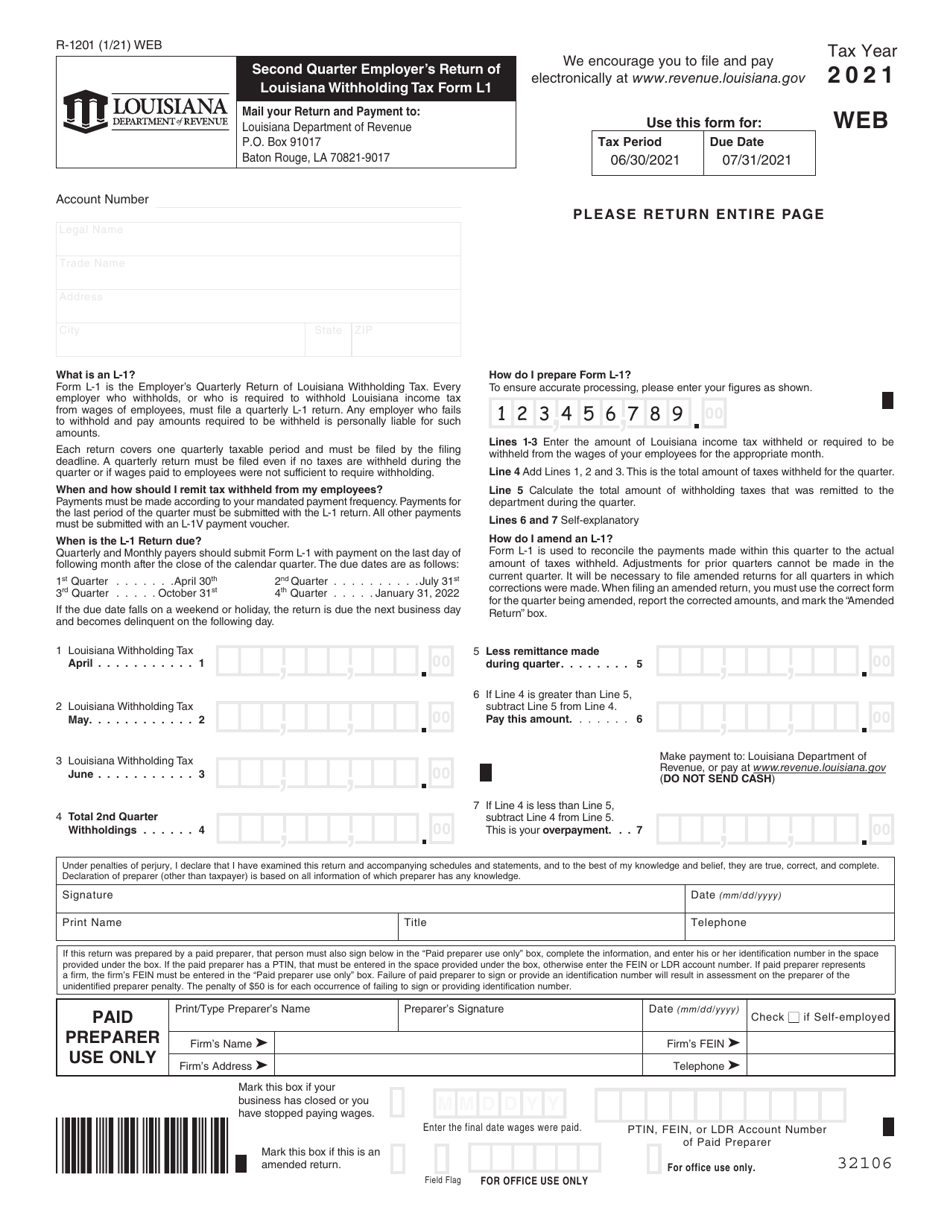

Form L 1 R 1201 Download Fillable Pdf Or Fill Online Second Quarter Employer S Return Of Louisiana Withholding Tax Form 2021 Louisiana Templateroller